Battery Storage Projects in Development

Charge Capital develops utility-scale battery energy storage systems (BESS) across the U.S. Our projects are structured to generate contracted revenue, may qualify for federal tax incentives, and are designed for institutional acquisition.

All projects are subject to change and may not proceed as described. Project descriptions are provided for informational purposes only and do not represent investment offerings. Investments are available only through official private placement materials provided to qualified investors.

FEATURED PROJECT

Michael's Plaza

-

Location: Eatontown, NJ

-

Status: Under Construction

-

Size: 660kw battery with six EV charging stations

-

Project Cost: $1.98 million

-

Revenue Pathway: Because the site is extremely well located, just off the most used Garden State Parkway exit to get to the north Jersey Shore, the revenue opportunity for Energy Arbitrage through EV charging is the highest of all possible arbitrage scenarios for this specific site location.

-

Projected 5-Year Gross Revenue: $3.95 million

-

Anticipated Incentives (paid at year of delivery):

- ITC: $792,000

- JCP&L Make-Ready rebate: $150,000

- NJDEP Corridor Grant: $180,000

- Total Expected Incentives: $1,122,000

(56% of total project cost)

-

Exit: We expect to package this project with other similar projects and sell to an institutional buyer. Many institutional groups, focused on energy capacity, are eager to aggregate battery energy capacity to create and control large “distributed energy grid systems”.

Sources & Uses

.png)

Targeted Returns

*Targeted Returns shown in this table have been reduced to 75% of proforma returns. Proforma returns are based on future revenue projections and incentives. Future revenue projections are gathered from third party evaluations and reports using best efforts. Charge Capital does not guarantee any returns or future proformance. Any returns shown are based on estimates and projections of revenues and expenses.

*The information presented in this case study, including but not limited to targeted costs, revenues, expenses, and projected returns, is based on current estimates and assumptions and is provided for illustrative purposes only. Actual results may differ materially due to market conditions, regulatory changes, construction costs, operational performance, or other factors beyond the control of Charge Capital Partners and its affiliates. Nothing herein should be construed as a guarantee of future performance.

A Growing National Market

According to the U.S. Department of Energy, energy storage capacity in the U.S. is projected to grow sixfold by 2030. By developing distributed systems under 5MW, Charge Capital positions projects to move quickly through permitting and interconnection, supporting both investor access and grid resilience.

Project Pipeline

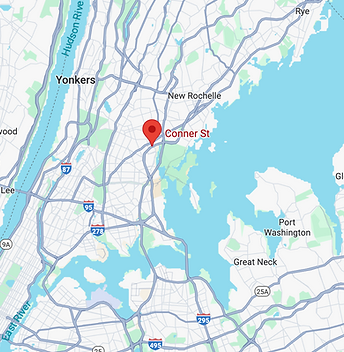

Charge Capital has a pipeline of over 300 sites in various phases of development. Below are some examples.

Charge Capital and its partners have an ever-growing site pipeline of over 300 sites throughout NY and NJ.

CHARGE CAPITAL PARTNERS

Project Pipeline

Xura has built a robust pipeline of battery storage and EV charging projects, positioning us at the forefront of addressing regional grid constraints while capitalizing on attractive incentive structures.This foundation reflects our disciplined approach to site selection and scale of opportunities secured. We are now expanding into additional states, creating a diversified portfolio designed to deliver long-term stability and growth for investors.

Pipeline Sites – Future BESS Deployments

CHARGE CAPITAL PARTNERS

Past Installations

Proven execution partner with a strong track record of completing hundreds of installations for Fortune 500 clients, supported by an active footprint across the Northeast.

Completed Installations

Explore Battery Storage Investment Opportunities

This page is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any investment opportunity will be made only through official offering documents and in compliance with applicable securities laws.